What else I loved doing for Lemonn

Lemonn man

The app personality

I've built the personality of the app by making a story about all the emotions our Lemonn man has while the users invest their dreams on the app there is someone feeling about their journey.Used in empty states, success, pending and failure cases etc.

Predictions

User journey and UI

Designing the flow for Lemonn predictions, where our research analyst suggests the atock to buy with the upside and duiration.

Mutual funds

Flows and IA

I also revamped the IA for mutual funds, making the existing flows less complicated and hassle free, with the revamp of the UI making it cleaner and less overwhelming.

Navigation

for super app and Indian stocks

I designed the navigation for the app, when the original idea was to create a super investment app with all investment categories under one roof, further for the lemonn app which included mutual funds and Indian stocks.

Prototyping

Interactive for the user testing

Instantly prorotyping the flows for floor testing and interviews has been something that I have learnt keenly with making the prototype interactive enough.

Accessibility

throughout the process

I have never let accessibility take a back seat and always made design decisions where it was considered as a priority, whether it is about contrast, legibility, readibility, layout, reachibilty etc.

Check Lemonn here.

Overview

LEMONN

Kicking off the most exciting thing with:

Designing for Compliance

Screens for STWT approval+Testing

STWT

SECURITY TRADING THROUGH WIRELESS TECHNOLOGIES (STWT)

Primary and secondary research followed by iterative process of designing, getting feedbacks on floor in loop

in order to send the design to SEBI for the approval of the product.

COMPETETIVE ANALYSIS

All the planets we travelled to make a Lemonn

GROWW

DHAN

ZERODHA

ANGEL

UPSTOX

To understand how the users are adapted to existing platforms and along with that how they are used to operating the various features, for example buying a stock and executing the order to sell it

The list on the left shows what all we covered in analysing the competitors initially.

USER RESEARCH

We sent out a survey asking our existing users their intent, challenges, platform choices, etc for Indian Stocks.The 2 cohorts we chose for this study were:

Active traders (Users who had made at least one successful trade in the last 30 days)

Active users (Users who were active in the last 30 days)

What users said about their problems?

Segregating the whole product into three main pages for the "not invested user:

Home page: The decision making starts from here and the variety of stocks listed on the home is not enough, users are tired of seeing the redundant and infamous companies and even seeing unknown and random listed companies is not helping them with the execution of their new trade

Asset page: the information here seems to be monotonous, just numbers is not something that a new user will fairly want to see and perceive, there is no separation of summaries and advance information

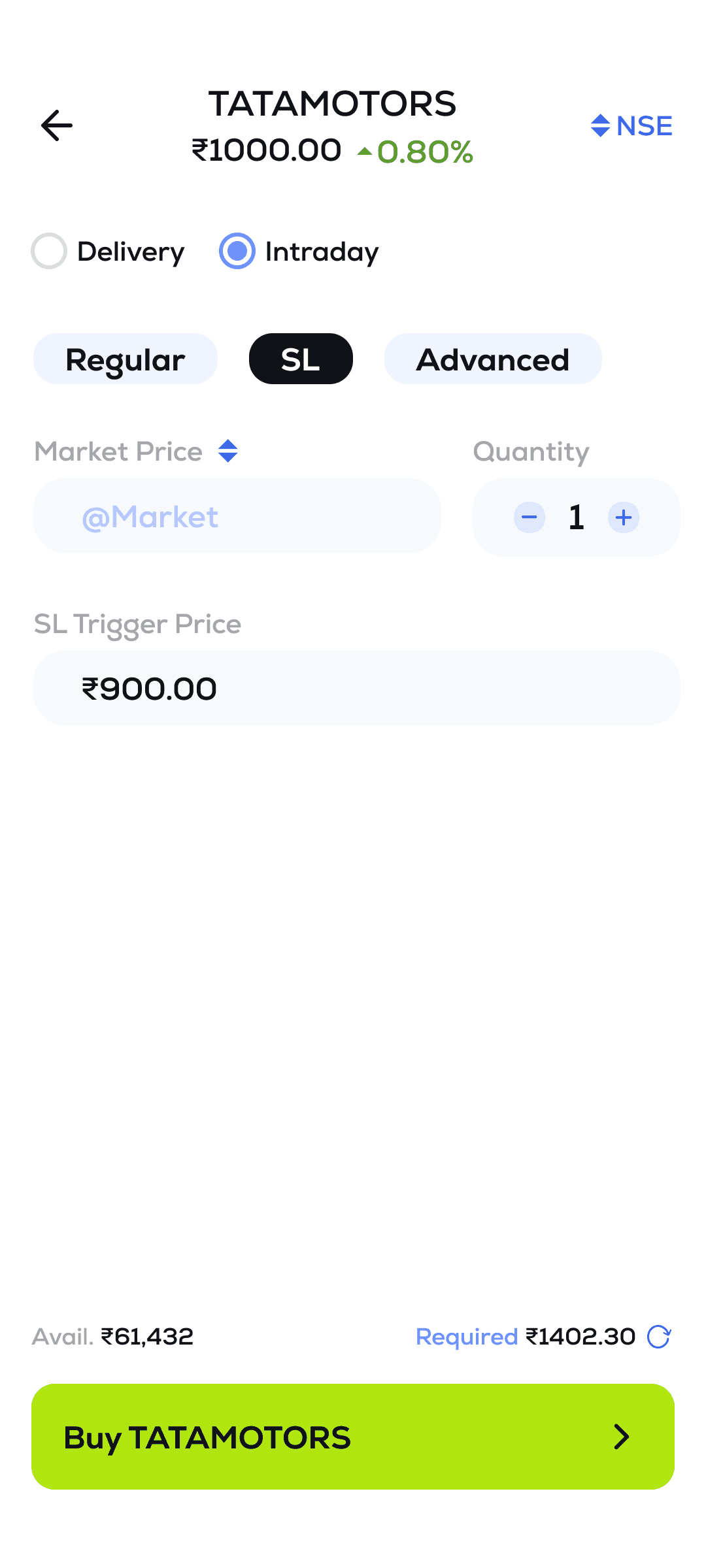

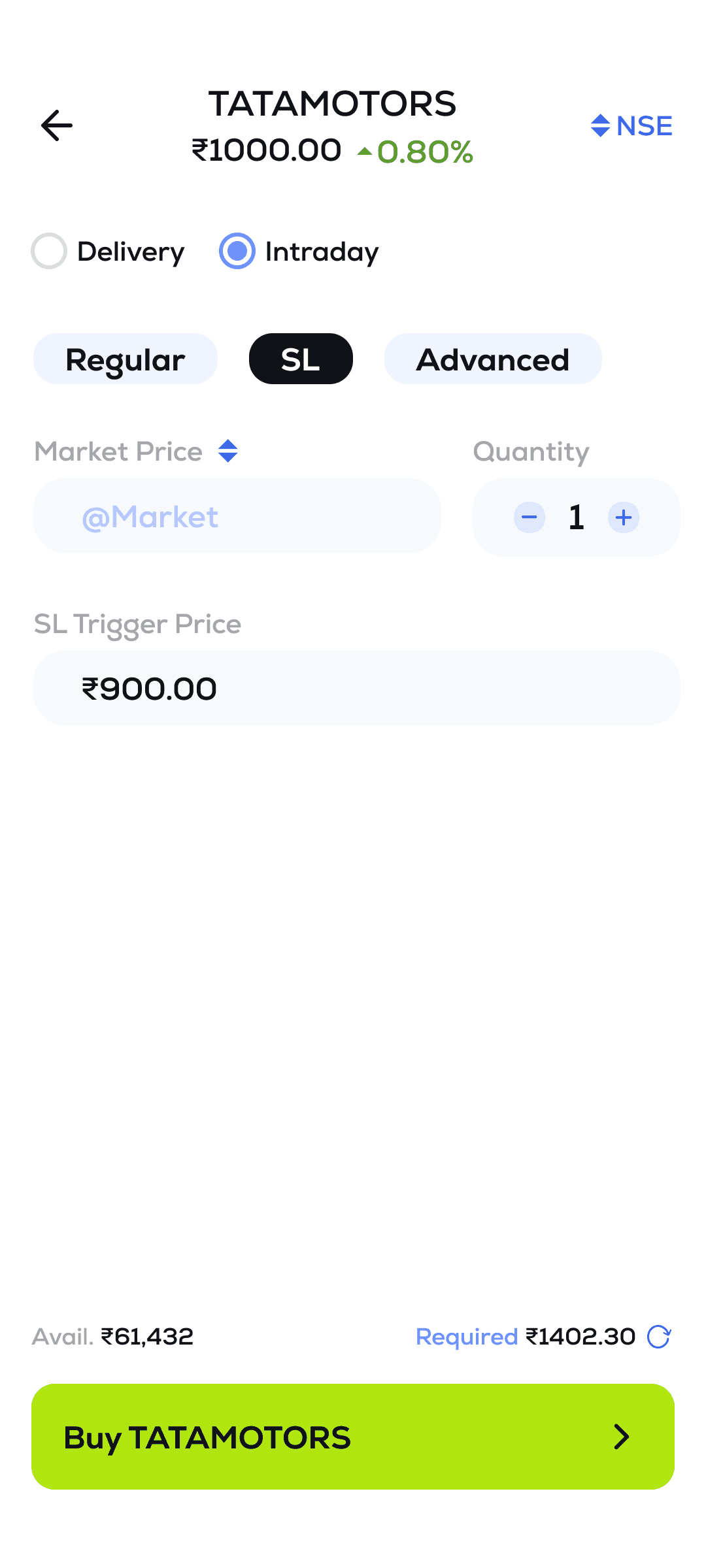

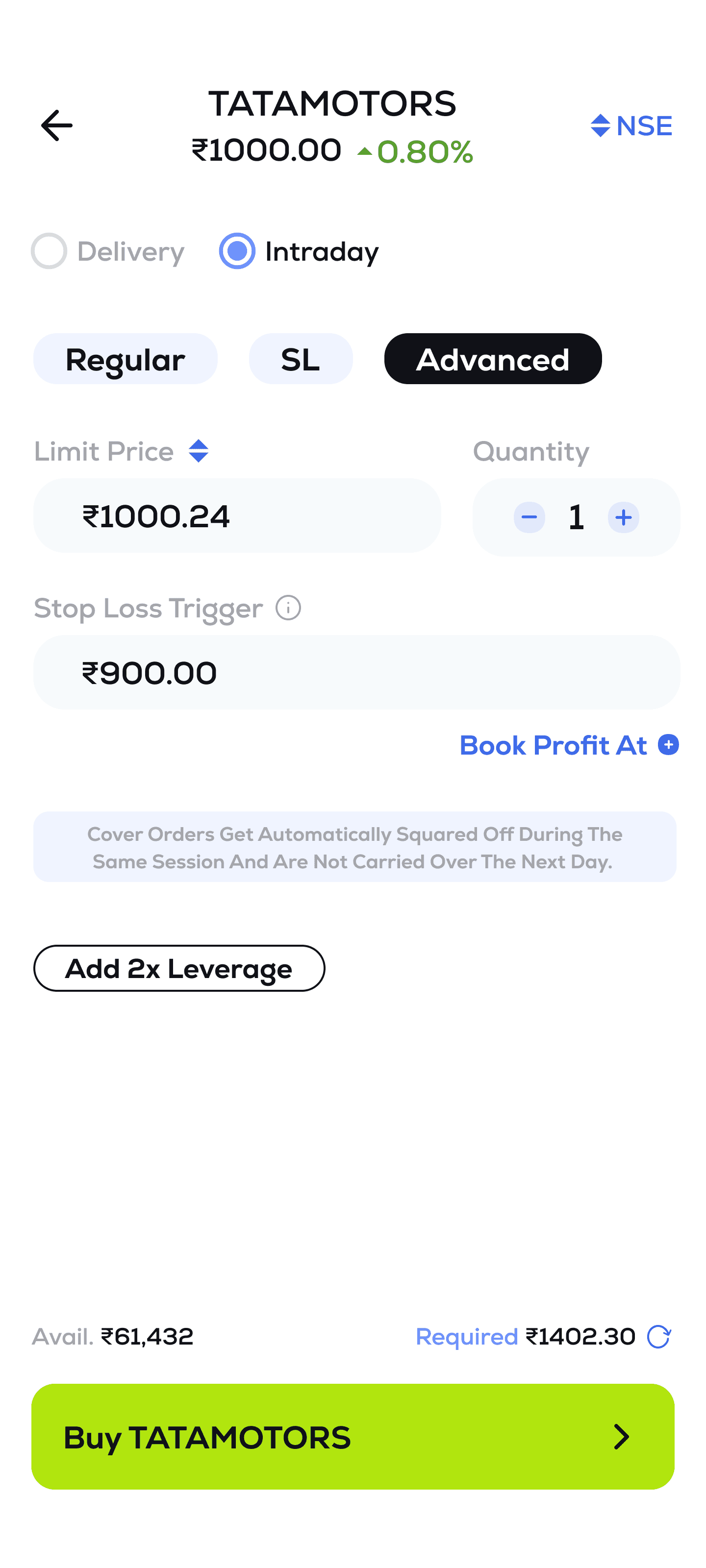

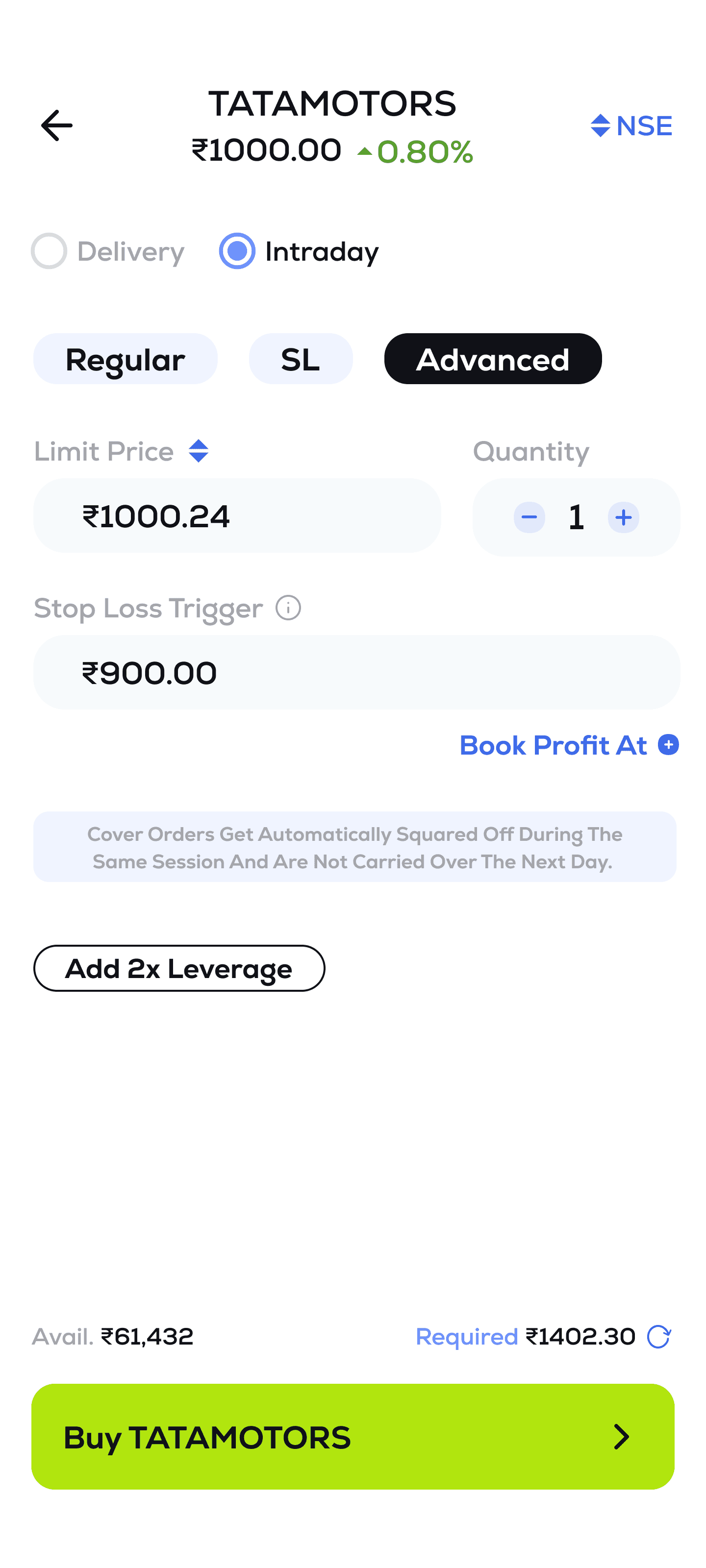

Order pad: Confusion seemed to be everyones problem, people who are less aware usually play a safe game. Not everyone is sure of the product under which they are executing and order and what the the different order types, it just goes with the flow of any app they are using to execute thier trade

How might we...

How might we increase the discoverability of stocks from the homepage itself?

How might we engage the users on the home page so that they are returning and navigating to assets in order to trigger a purchase?

How might we ease the understanding of the users about the stock market

How can we not compromise on the accessibility across themes and flows?

Game? stocks made fun.

The one of the first takes on increasing discoverability of stocks is engaging the users with something that they want to know and know more about

HOME

Play to

learn

Right

Success

Fun

Facts

Play again

View asset

MUNCH

Start>

Choosing

brand

Wrong

Try again

Fun

Facts

Play again

View asset

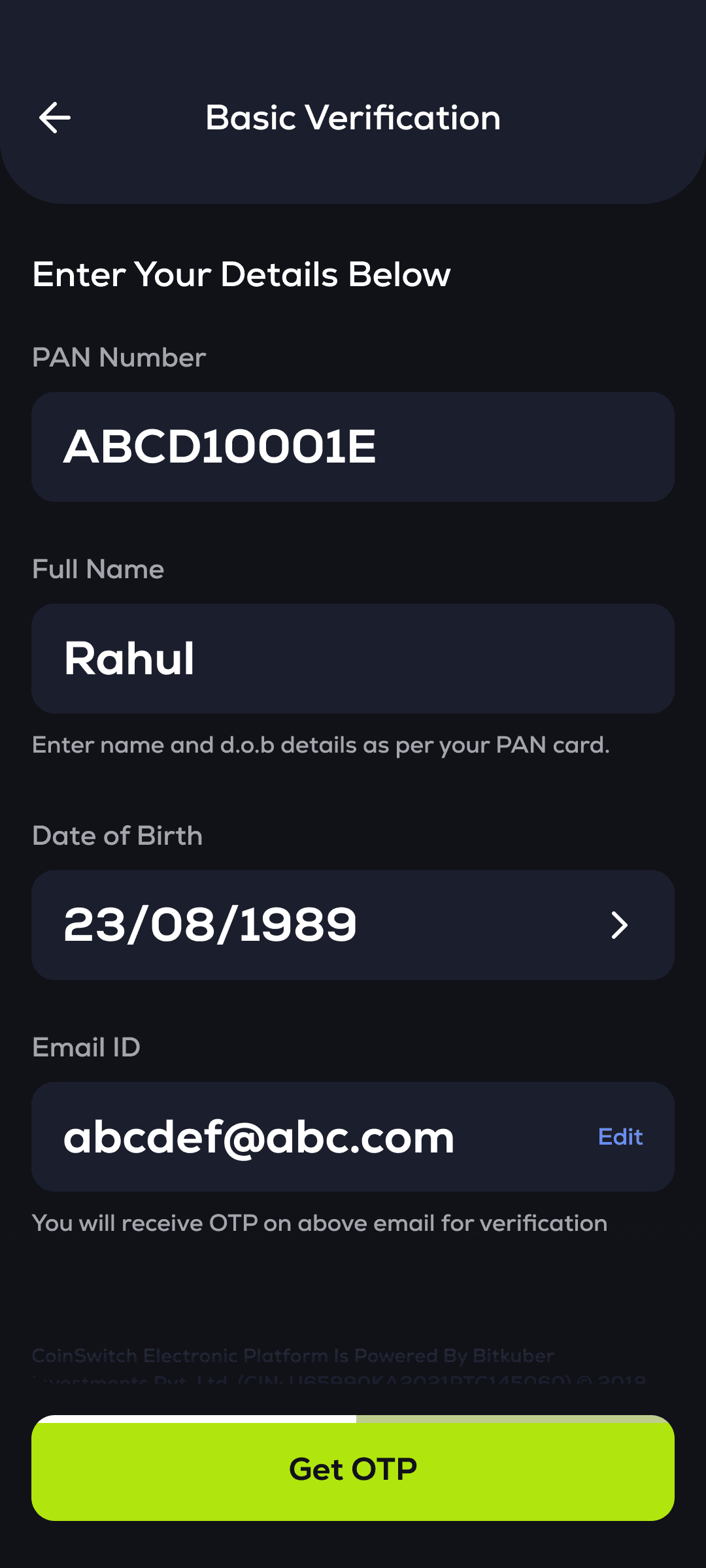

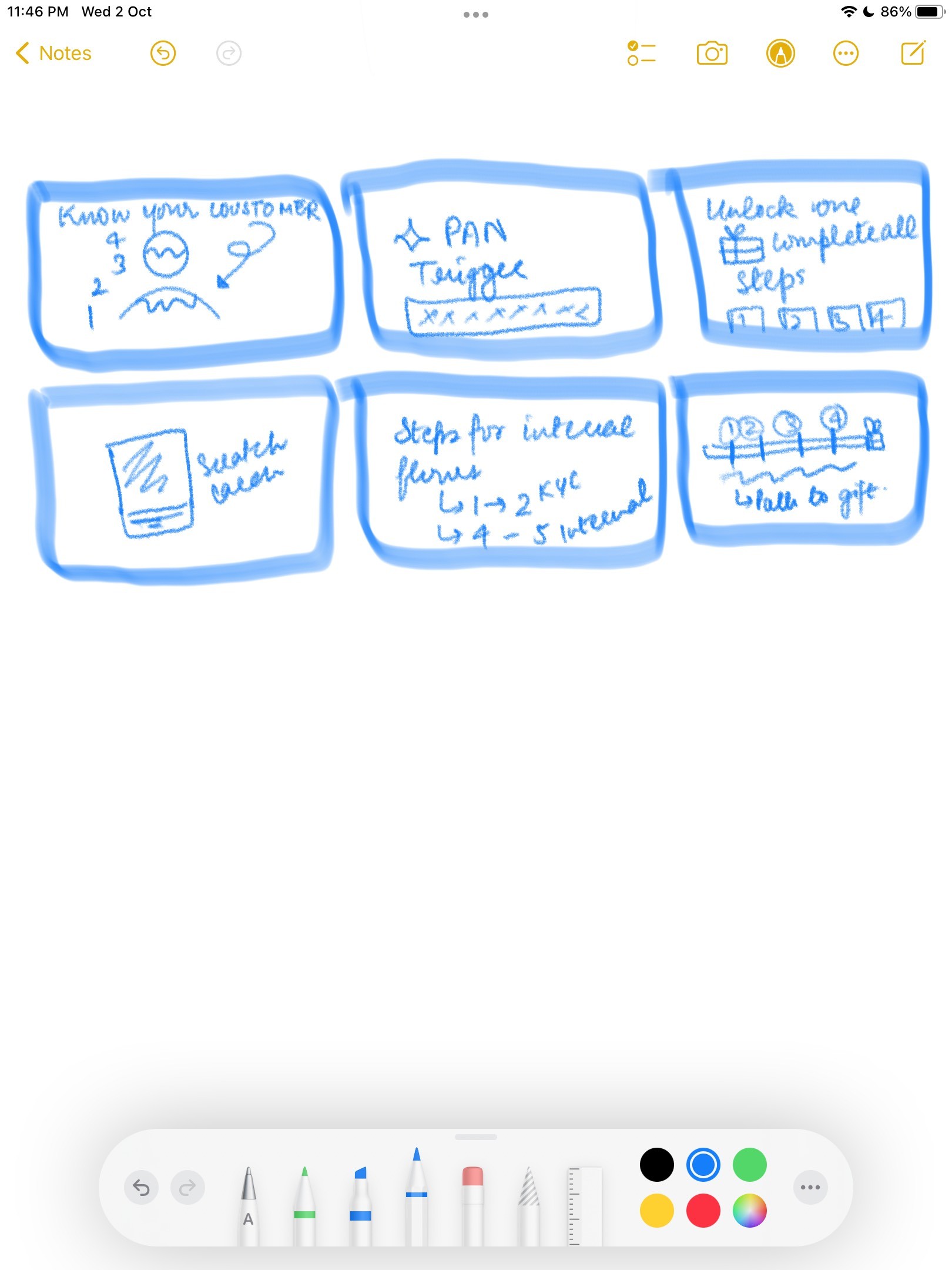

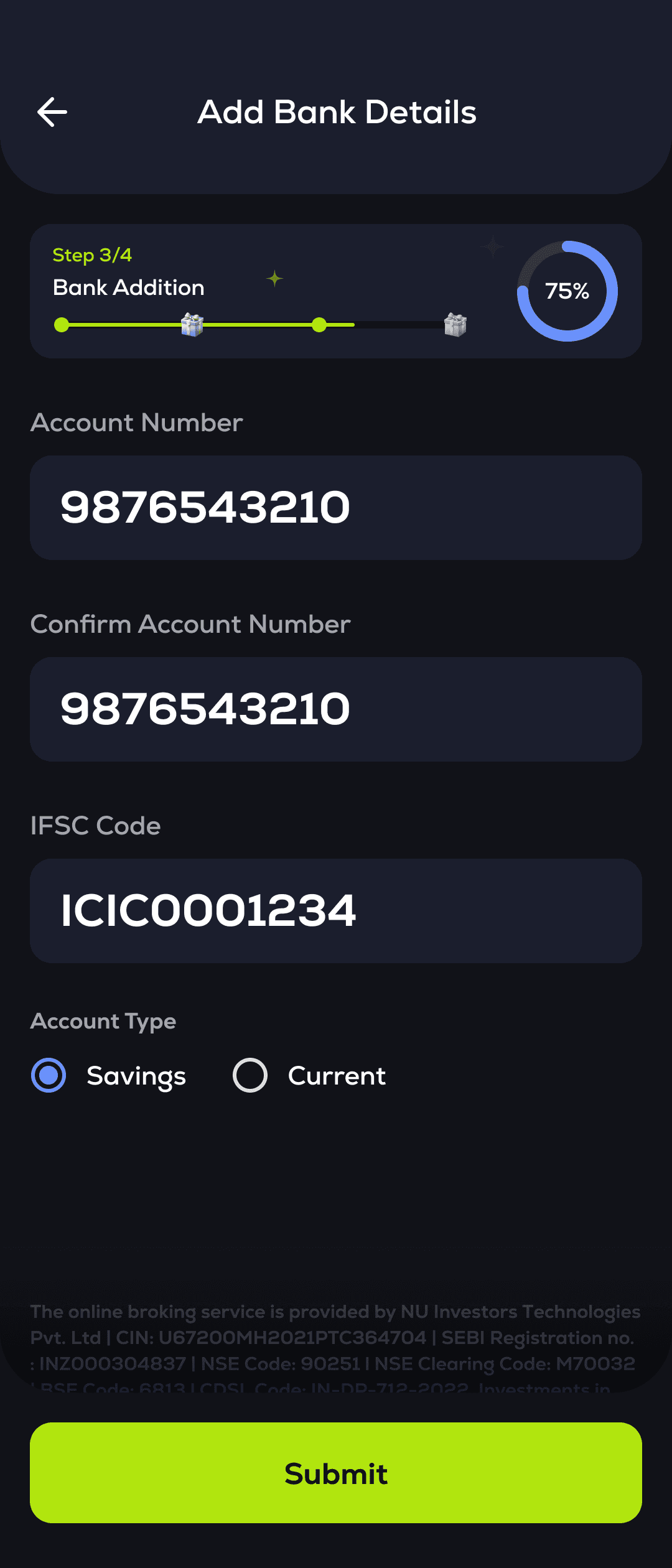

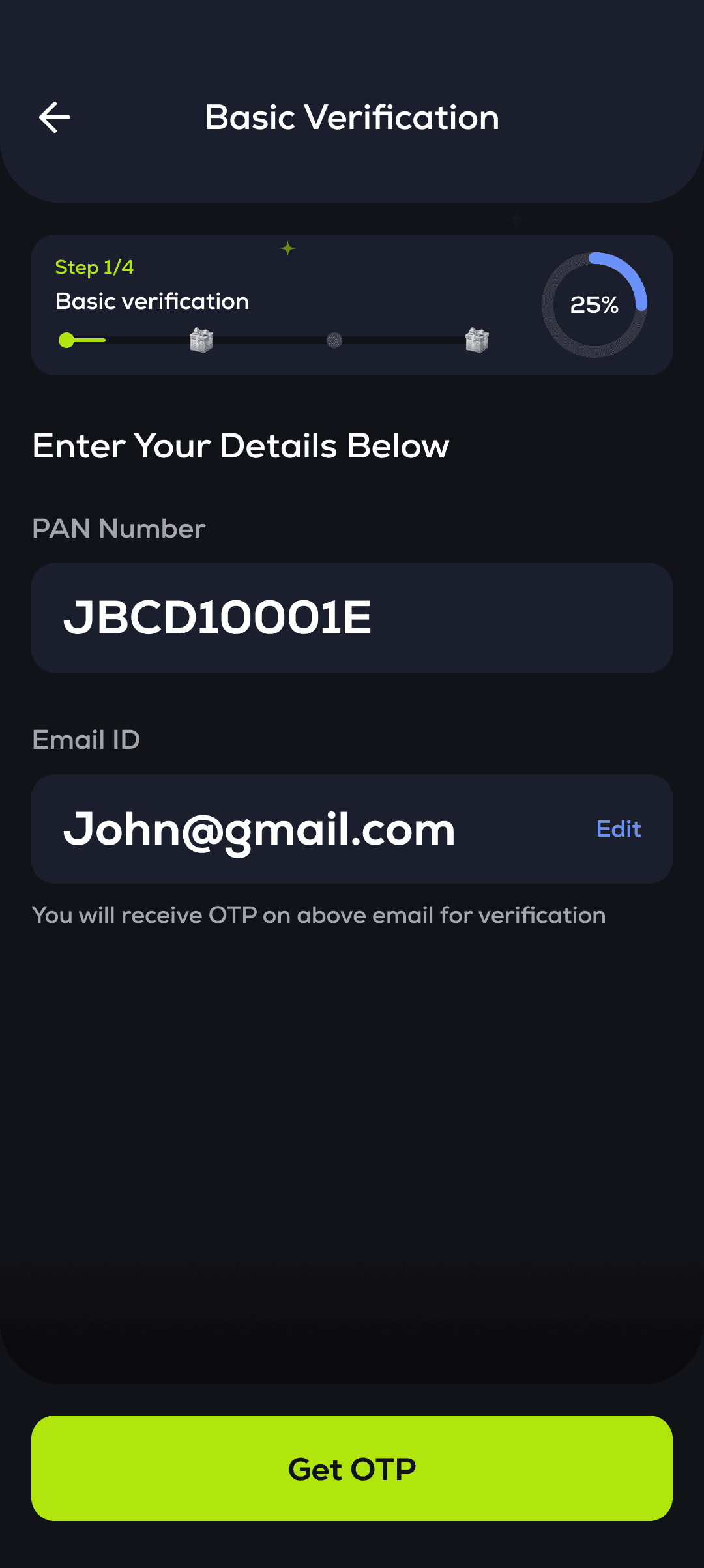

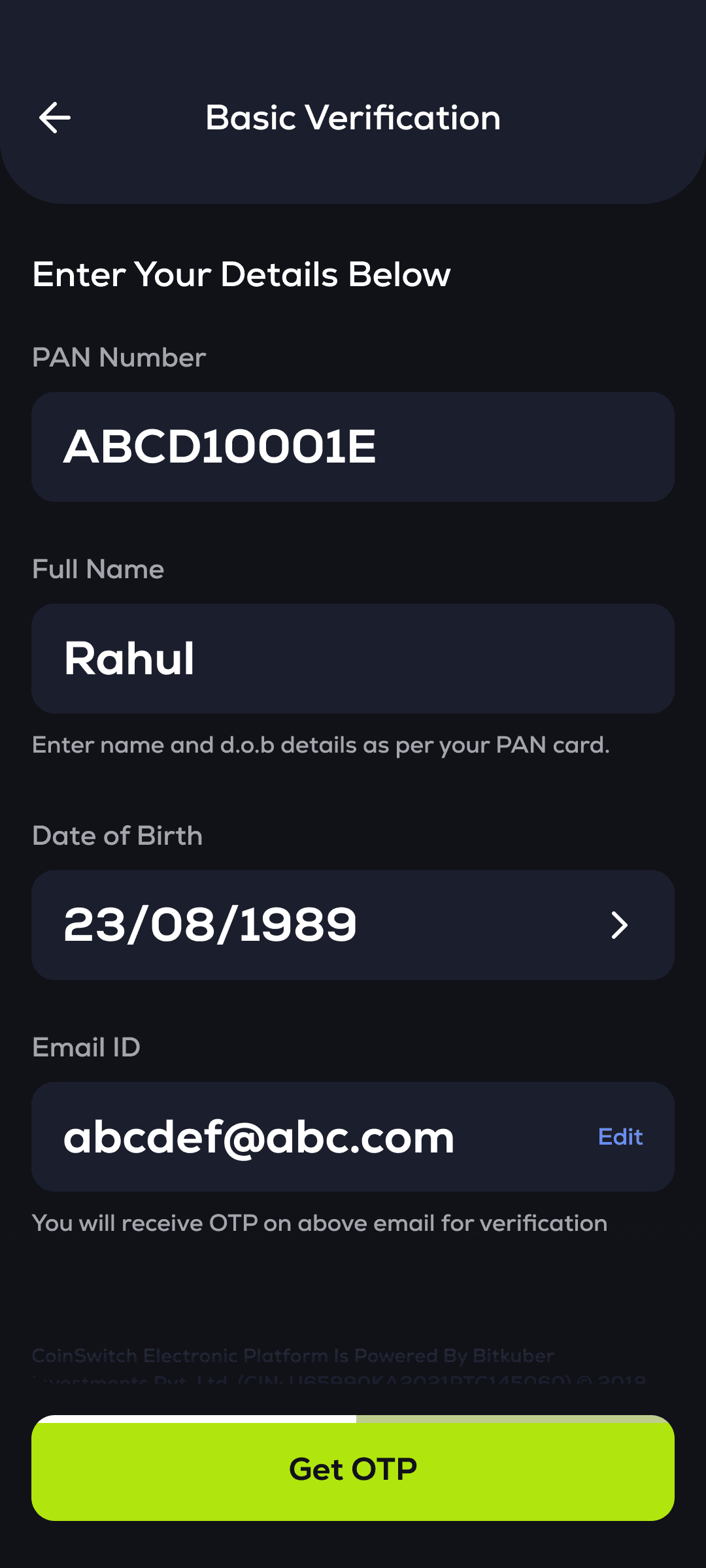

Let’s dive into some KYC revamp

Few months after launch KYC was at 9% completion rate (Organic traffic) this really needed some acceleration

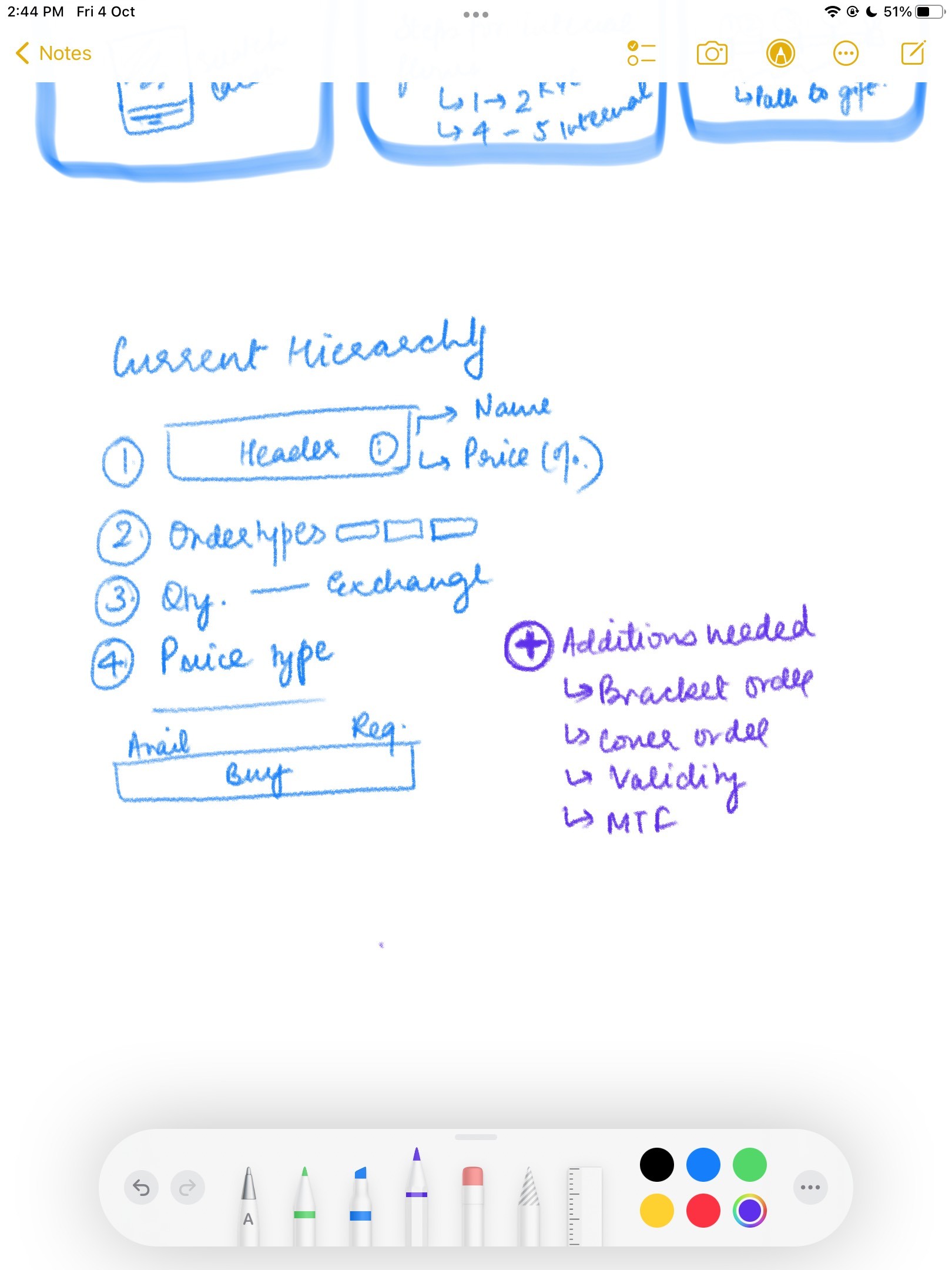

Order execution flow

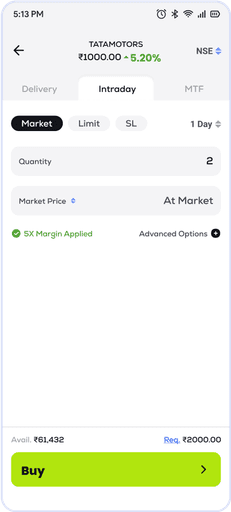

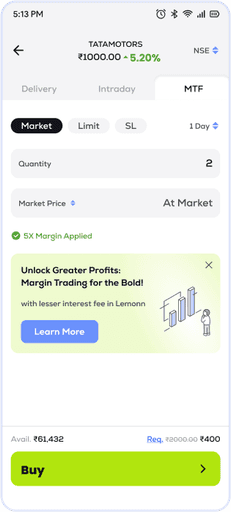

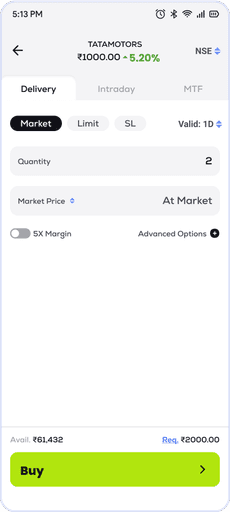

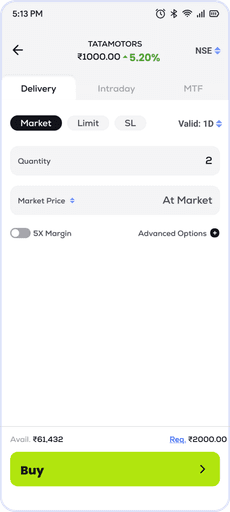

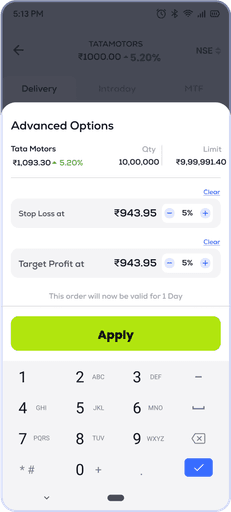

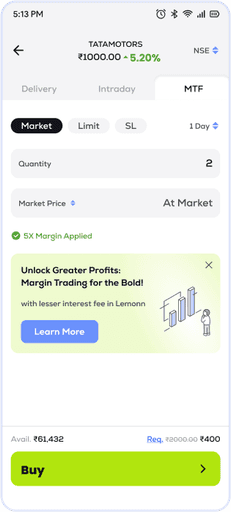

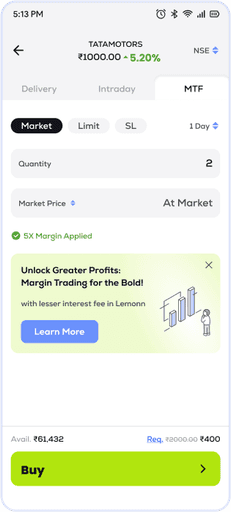

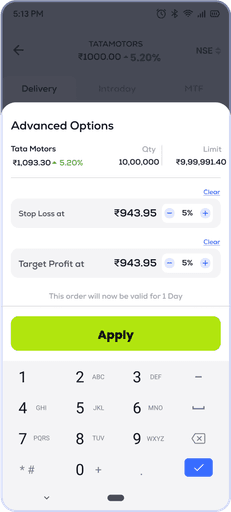

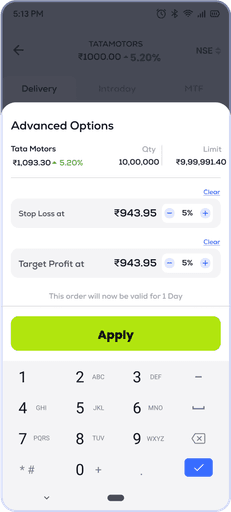

Order execution flow was something that I started the journey of Lemonn with, this needed bigger changes as the product was maturing, the types of order increased and hence we started a redesign sprint

What I learnt?

Designing the whole product from scratch was quite an experience, I have developed great understanding of so many things

An important area of development for me was prototyping. I discovered that it's important to iterate based on feedback in addition to creating something that looks excellent. I learned something new from every iteration of the prototype, whether it related to functionality or usability. I embraced the idea that failure in early stages is only a stepping stone to improvement.

My learning approach was significantly aided by collaboration as well. Collaborating with interdisciplinary groups has enhanced my appreciation for diverse viewpoints and abilities. It made me realize how important open communication is and how different perspectives may result in a stronger final product.

Finally, I became more aware of the need to strike a balance between creativity and pragmatism. Though it's simple to become buried in creative concepts, I discovered that maintaining

Before

Usually on competitive platforms the information is very scattered, it is only okay if the user gets used to it.

The decision to keep all he action items on one side of the screen with a very clean design was a win.

12 internal employees were shown both designs STWT and MVP

7 were shown STWT first and 5 were shown MVP first

There was a mix of investors who have been in the market for a couple of years as well as new investors

User selected make trades from intraday to long term investments and also do options trading

Intent

After few user calls it was clear that the users’ intent to go ahead was surely lacking

Procrastination

“Will do it today” “forgot to come back” etc. were some words that I caught hold of

Trust

Users had doubts about the credibility of the product and could not see it as authentic

To much of work

Filling all the forms, answering questions, checking boxes etc. are definitely too much for one go

How?

How might we increase Intent of the user to reach the end of KYC flow?

What can over power their procrastination to complete the task?

How might we increase the authenticity of the process and product?

How might we make the steps look lesser and easier?

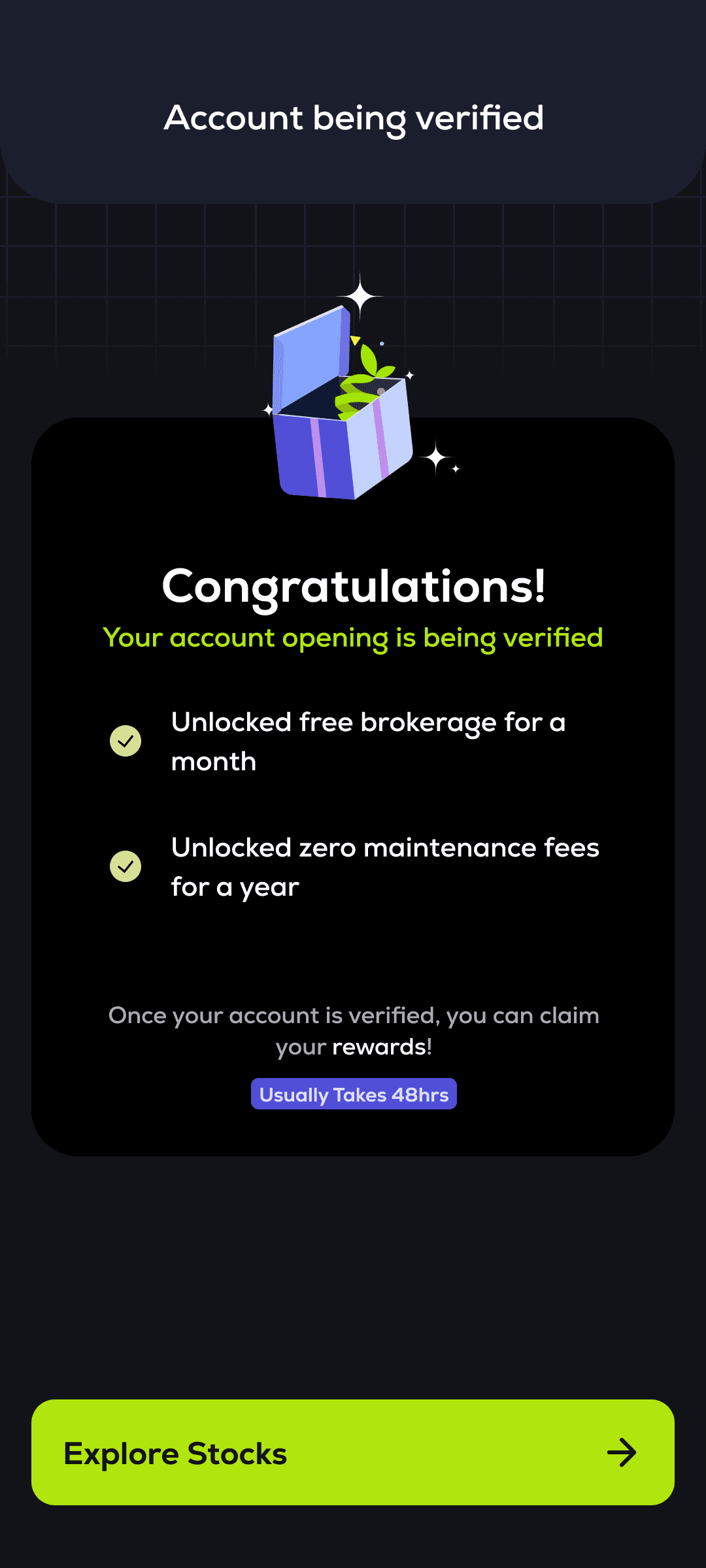

REWARDS

Zero Brokerage | No account maintenance fee

OLD

NEW

Intent.

How to get that?

The way to get intent is to give incentive. As we were already giving free brokerage and no account maintenance fee for to all the users for certain time, why not sell it?

Procrastination

How not to?

Building intent is one way to solve it but if we manage tasks in a way where the no. of tasks are same but they appear to be half of it, this is exactly how

I managed this.

Trust

How to build?

All the first phase designs and STWT approval are given from SEBI, we need to use them to show authenticity. Giving affirmation through copies is another way to go about.

To much of work

Can we reduce?

We obviously can’t, everything is important from compliance point of view but surely there can be some visual delight with minimizing cognitive load.

25%

Progress

Verification

Basic

Veirfication

Step 1

Info.

Context

setting

NO CTA

HOME

Entry

Point

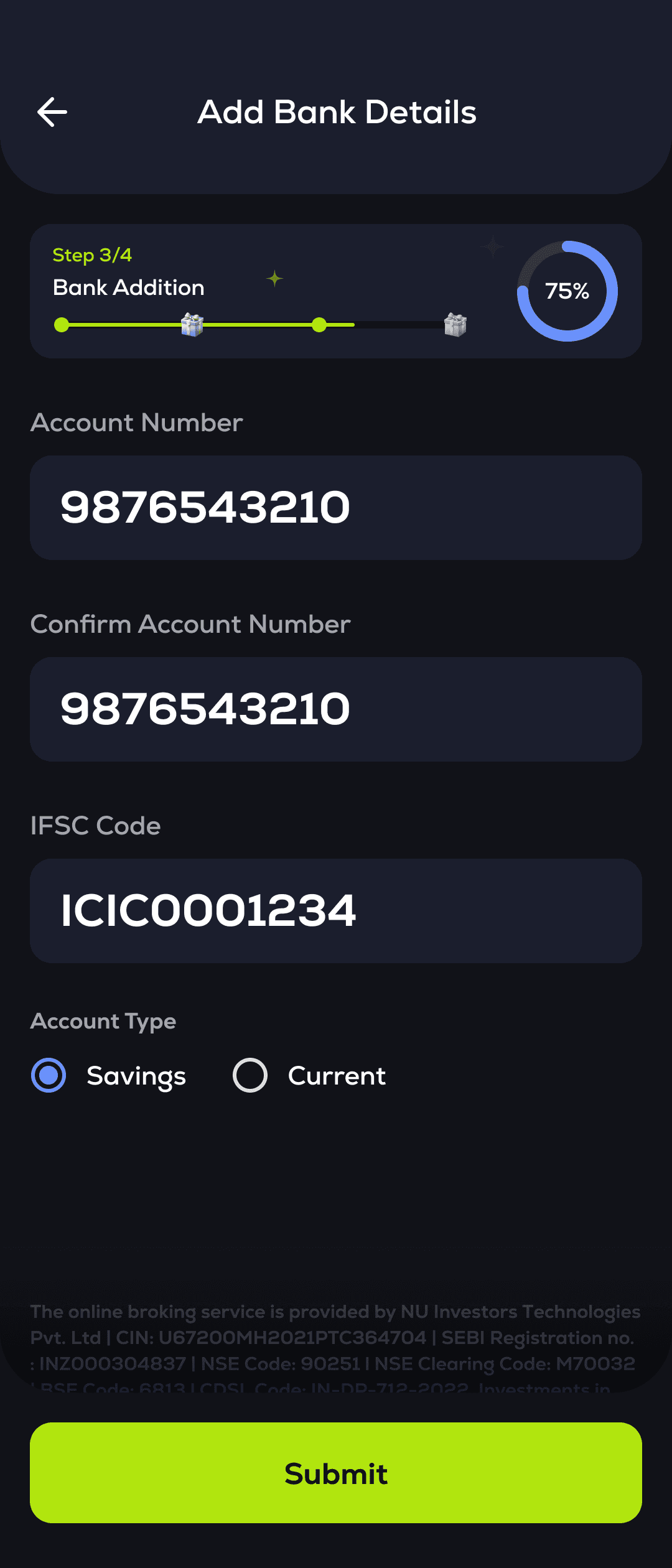

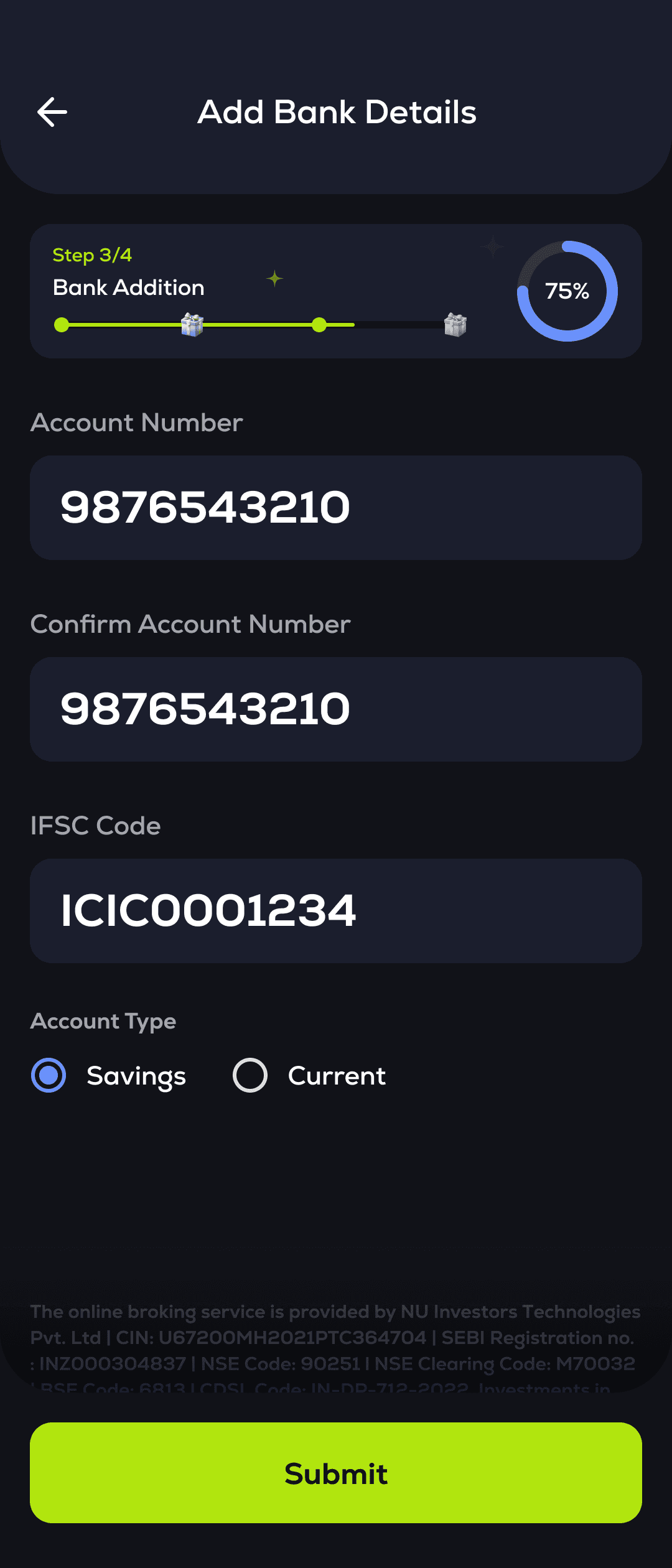

50%

Progress

Details

Additional

Step 2

75%

Progress

Bank details

Input

Step 3

Nominee

Re-

direction

Continue

Skip

Choosing

100%

Progress

Declaration

Check boxes

Proceed to sign

HOW DID WE LAND THERE?

There were several iterations before coming to the final stages which included taking the decision between:

Game should flow from stocks to brand?

Or stocks to brand?

Game at present has a click rate of 65%, letting the users explore the unknown stocks!

With the usability testing, it came to knowledge that it is not just a medium of discoverability but also education

Creating an app from scratch involved 100+ iterations and repetitive feedbacks from everywhere.

From sitting with the insights team to the reviews with the developers was a thrilling journey!

ENHANCING DISCOVERABILITY VIA GAME

63%

Increase in sign ups

87% success rate from KYC to trade ready

ARCHITECTURE

OVERVIEW

Identify 4/5 brands under the company to win

Play & win big!

Select a company to begin the game

Play This game

#2 Brands to Stocks

Unilever

Adani Group

ITC

#1 Stocks to Brands

Identify 4/5 brands under the company to win

Play & win big!

Select a company to begin the game

Play This Game

Munch

Kit-Kat

Maggi

PROS:

Option to select multiple answers which gives it a game like feel

With more selection, more hopes of winning

Recognition of a less known stock may lead to drop-off

Brands are more common and can be related and recognized more frequently acted on

CONS:

PROS:

Brands are more common and can be related and recognized more frequently to engage with

More chances for the users to recognize more brands

CONS:

Ability to only select one answer in the inner which can make it less competitive

Step 6

Decleration

OLD

FLOW

OVERVIEW

Step 1

Basic Verification

Step 3

Addiotion Details

Step 5

Nominee Addition

Step 2

Digio Verification

Step 4

Bank Addition

Step 7

E-Sign

Step 8

Create Password

Step 6

Decleration

All these steps contained multiple screens with some cognitive load on each screen, without any visual delight and a lot of work to do

NEW FLOW

Get.

Set.

Go.

Create your account and win worth ₹1000 rewards

Get full proof ready, just in 5 mins

Unlock your 1st reward after basic verification

Unlock your 2nd reward after Bank addition

LET US GO!

Info.

Context

setting

Reward in

next step

Digio

Re-

direction

Reward in

next step

Success

Info. about

the reward

claim

Nominee

Flow

Skip

Continue

Intraday

Delivery

Order Type

Market

Limit

SL

TATAMOTORS

₹416.30

0.80%

1

Quantity

NSE

₹407.25

Limit Price

The online broking service is provided by NU Investors Technologies Pvt. LTD | CIN: U67200MH2021PTC364704 | SEBI Registration no. : INZ000304837 | NSE Code: 90251 l NSE Clearing code: M70032 | BSE Code: 6813 l CDSL Code: IN-DP-712-2022. Investments in the securities market are subject to market risks; read all the related documents carefully before investing. Read more...

Your order is valid until the market closes today

Buy TATAMOTORS

Avail. ₹61,432

Required ₹416.30

Redesign scope

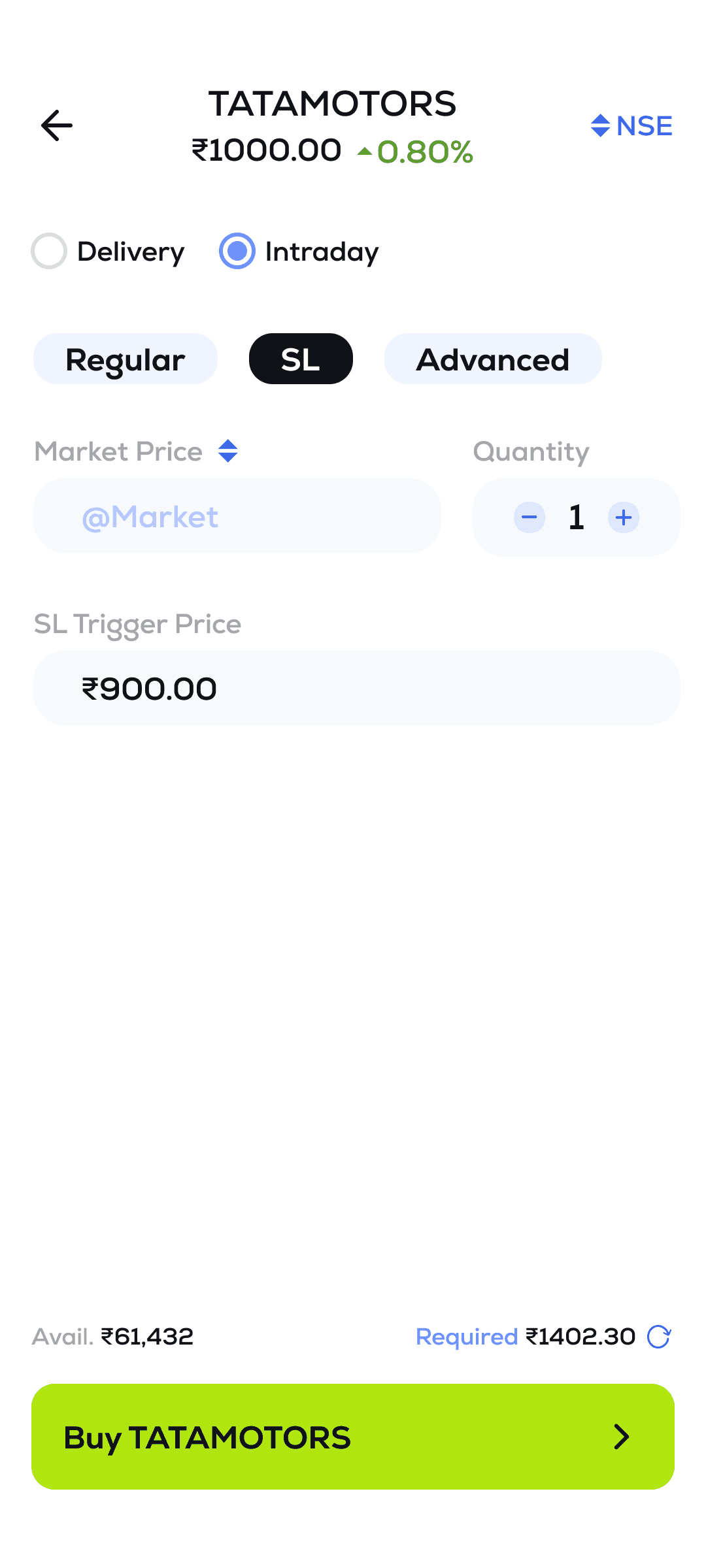

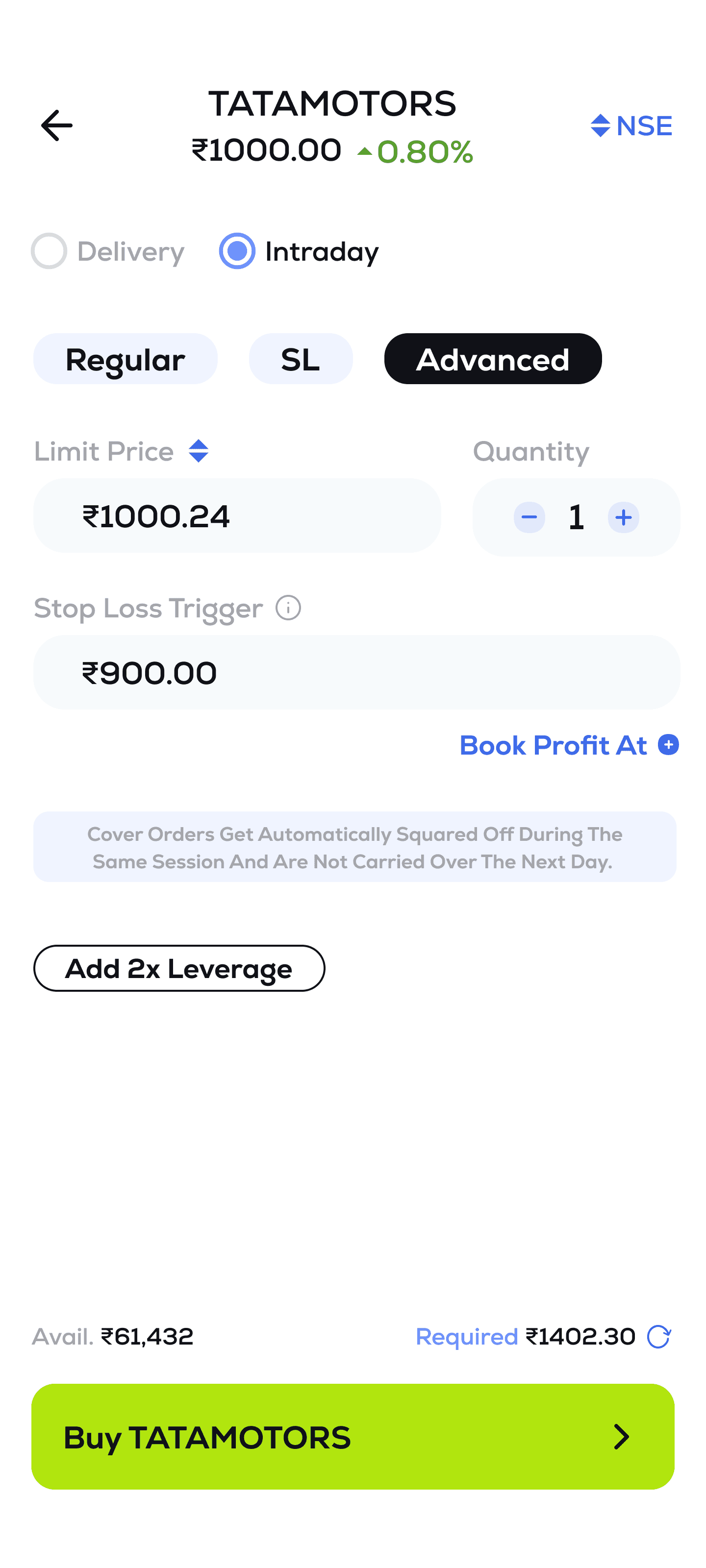

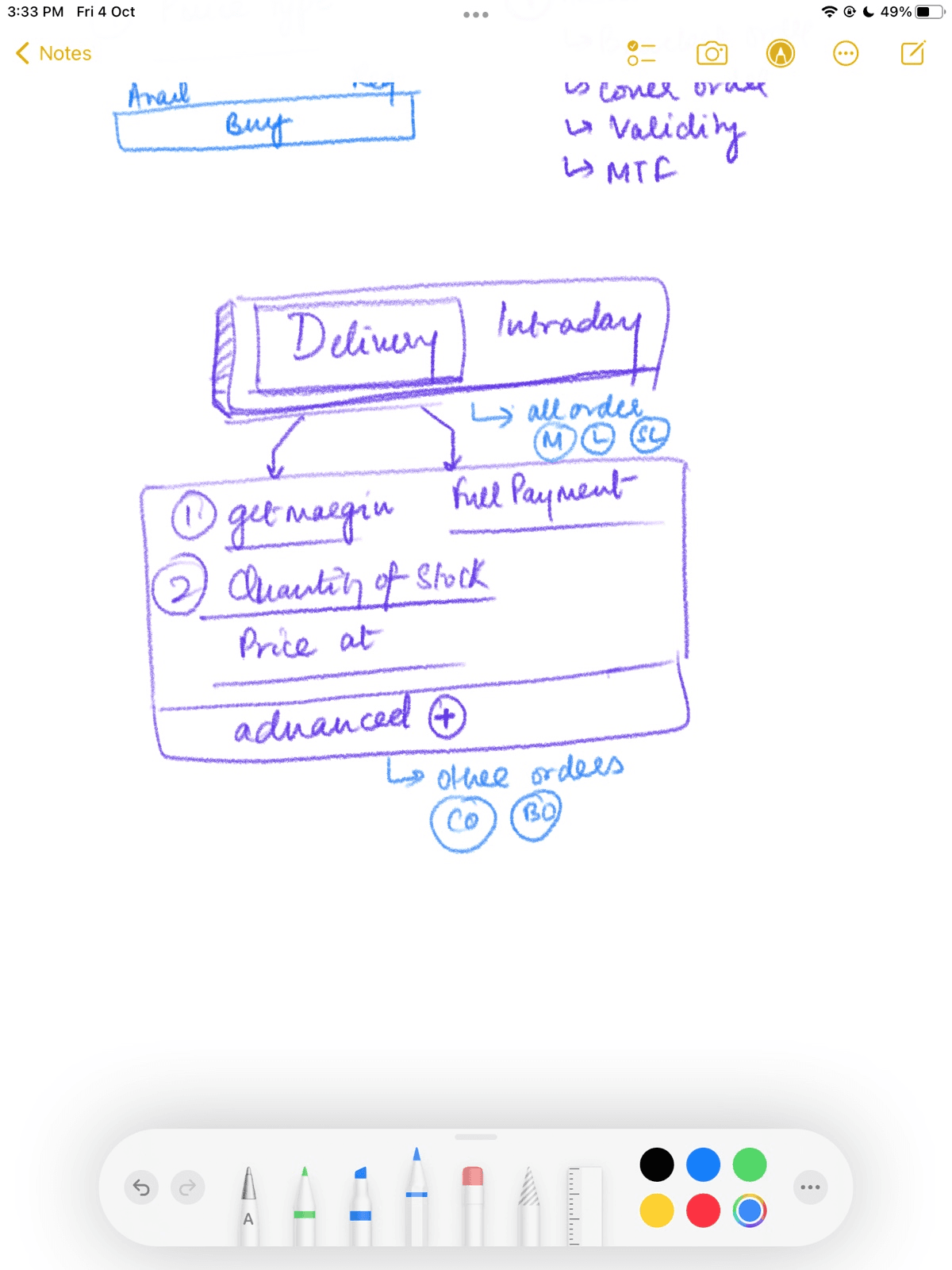

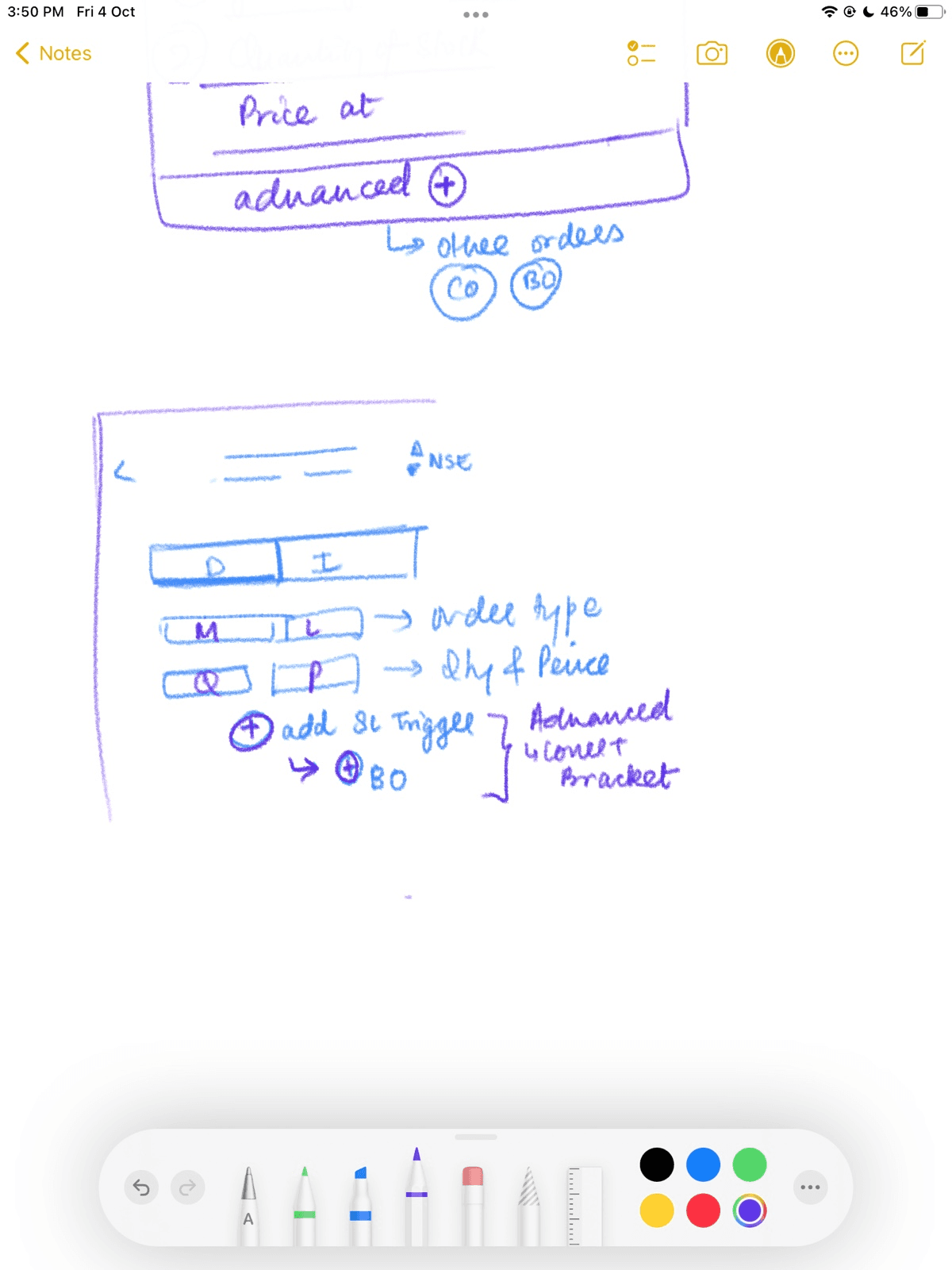

We needed different order types with a lot of complicated combination. These were:

Iteration 1 | Wireframe :

Case 1: MTF (Margin traded funds) was in a scope of not being called out upfront in the UI and the margin can be added to the stock, going forward with this:

Margin is only available in delivery orders

Final design :

Making MTF a third product type. The final design was much in sync with the first iteration the capabilities differed

DELIVERY

INTRADAY

MTF

Iteration 2 | Wireframe :

Here the advanced section is not called out specifically with the hypothesis that advanced users will know and naive users will not risk it

BREAKING DOWN

ALL THE ORDER TYPES FOR A SIMPLER FLOWe

Initial

Wireframes

Few other

Iterations

Crazy 6s

TATAMOTORS

₹1000.00

0.80%

NSE

This will hold information about pledging the mtf owned

Avail. ₹61,432

Required ₹50.30

Buy TATAMOTORS

Delivery

Intraday

Pay full

Get 2x margin

Quantity

1

Price at Market

@Market

Advanced options

TATAMOTORS

₹1000.00

0.80%

NSE

Avail. ₹61,432

Required ₹1402.30

Buy TATAMOTORS

Delivery

Intraday

Advanced options

SL

Cover

Quantity

9

Trigger Price

₹1348.59

Price at Market

@Market

Target profit at

TATAMOTORS

₹1000.00

0.80%

NSE

Avail. ₹61,432

Required ₹1402.30

Buy TATAMOTORS

Regular

SL

Quantity

1

Market Price

@Market

Stop loss trigger

Delivery

Intraday

Validity

TATAMOTORS

₹1000.00

0.80%

NSE

Avail. ₹61,432

Required ₹1402.30

Buy TATAMOTORS

Regular

SL

Quantity

1

Market Price

@Market

Stop loss trigger at : ₹0.00 |

Exit Target Price

Delivery

Intraday

Validity

Cover order

Add target profit and it becomes a bracket order

MTF

Validity

STWT

Order pad designed for SEBI's approval

MVP

Order pad designed to face the users after launch

Current

Order pad designed after user testing and scoping

Phases

Example of how designs changed with the phases : order execution flow.

Check Lemonn here.

Role

Product designer for stocks and mutual funds

and pro version of stocks (web)

one of two Founding designers for stocks vertical - Lemonn

Project Type

Building an Indian stocks app from the ground up

Overhauling the mutual funds interface

Prioritizing user experience and interface design

Industry

Finance Technology

Indian Stocks | Mutual Funds | Crypto

CoinSwitch & Lemonn

This project is best viewed on desktop

LEMONN

Overview

USER RESEARCH

We sent out a survey asking our existing users their intent, challenges, platform choices, etc for Indian Stocks.The 2 cohorts we chose for this study were:

Active traders (Users who had made at least one successful trade in the last 30 days)

Active users (Users who were active in the last 30 days)

What users said about their problems?

Segregating the whole product into three main pages for the "not invested user:

Home page: The decision making starts from here and the variety of stocks listed on the home is not enough, users are tired of seeing the redundant and infamous companies and even seeing unknown and random listed companies is not helping them with the execution of their new trade

Asset page: the information here seems to be monotonous, just numbers is not something that a new user will fairly want to see and perceive, there is no separation of summaries and advance information

Order pad: Confusion seemed to be everyones problem, people who are less aware usually play a safe game. Not everyone is sure of the product under which they are executing and order and what the the different order types, it just goes with the flow of any app they are using to execute thier trade

NEW

Cover order

Add target profit and it becomes a bracket order

MTF

Validity