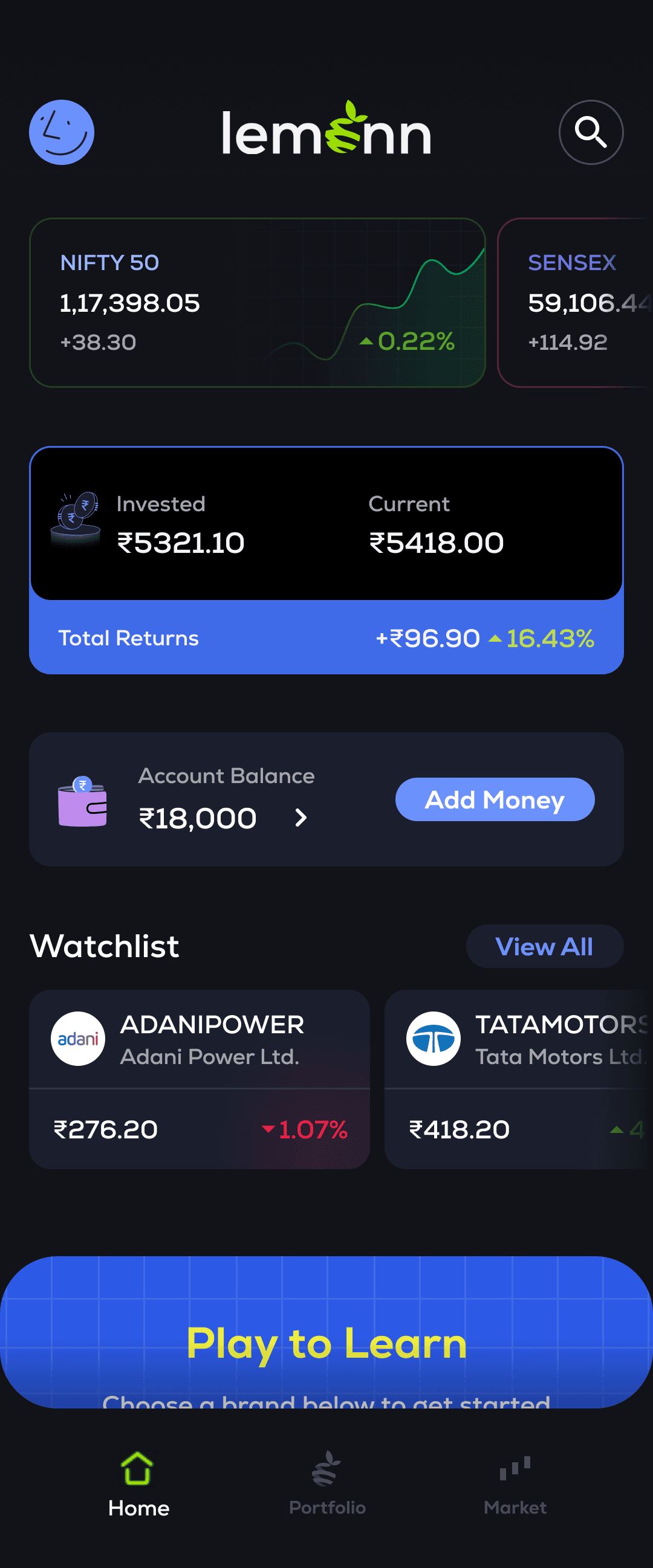

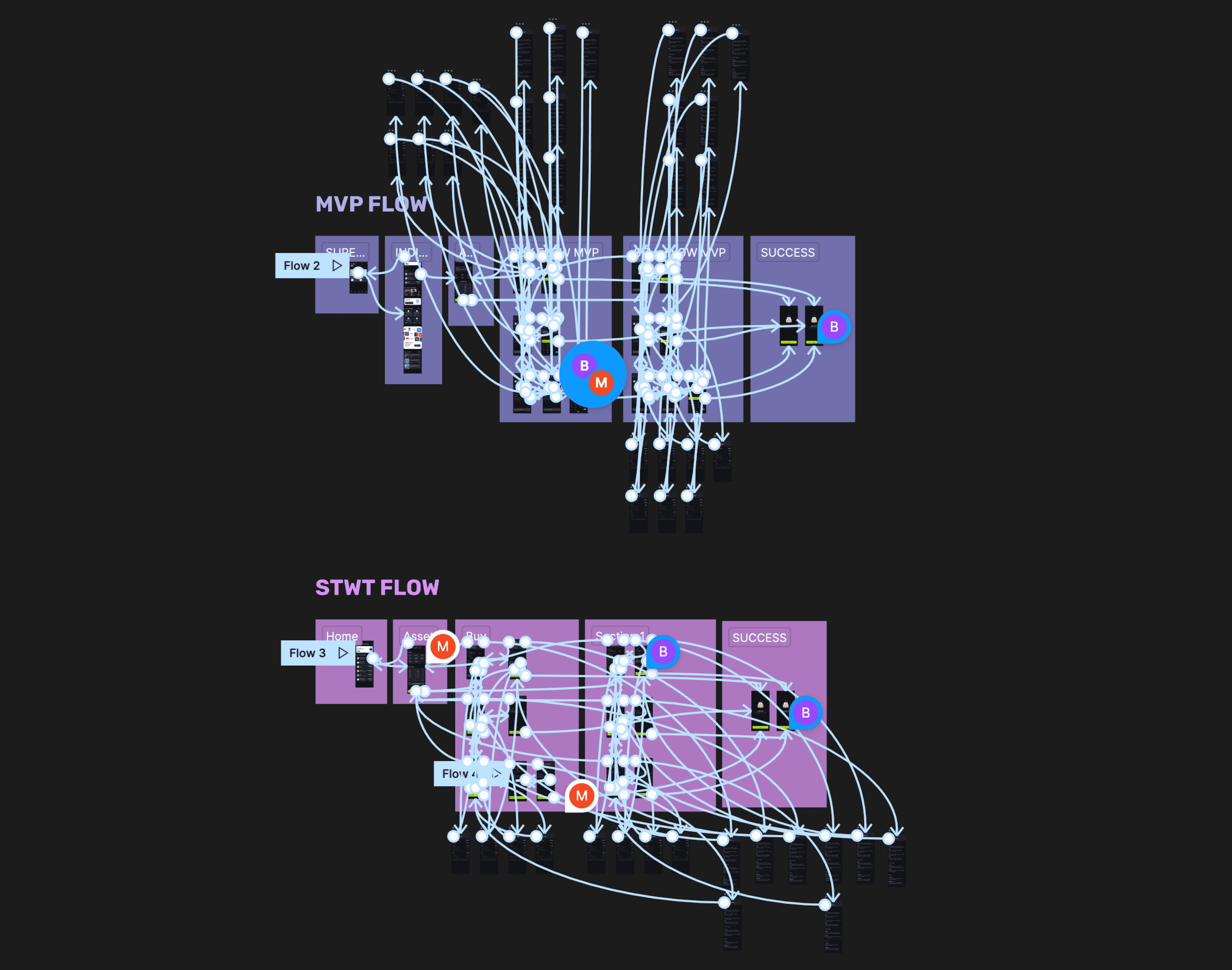

Phase 2 | MVP

From April 2024.

We started designing the MVP

while we were still on our STWT

STWT (Phase 1) a mandatory step required by SEBI for any trading platform trying to enter the Equities space. This step involves showcasing a very basic version of the app/website which will be used for trading. On approval of the STWT auditor, the same flow would be made using new components and improved UI elements.

Role

Product designer | Team of 2

Project Type

MVP for Indian stocks, from ground up

Duration

February 2023 - March 2024

Problem statement

Aiming to enable users invest in Indian Stocks through clear understanding by simplifying flow, minimizing jargons and increasing discovaribility within the app which in turn brings down the learning curve.

Approach

Insights

Summary

We got a quantitative understanding from the users about their intent, platform choice, decision making, challenges, etc and wanted to further understand these aspects in depth.

Next Steps

We cohorted the respondents into people who already invest in Indian stocks and those don’t invest but plan to invest to understand more about the platform they currently use, how they make buy/sell decisions, the pain-points & challenges they currently face while trading in Indian stocks.

We were able to have insightful conversations with 27 users out of the 92 users that we reached out to and were able to understand their investment experience/journey.

We identified that most of our users are in the early stage of their Indian stocks journey (0-2 years), did affinity mapping to understand the needs of these users to help build the ideal platform to help them invest in Indian stocks.

Affinity mapped

based on the above research

Research

Listens to podcasts

Chooses Mutual funds based on info provided by Groww

Analyst calls

Invests based on friend's advice

Based on News

Follows Youtube channels/ influencers

Based on how stocks performed in the last 5 years

Mails from the current in use platfor

Google

strategies

Based on demand in market, PE Ratio, Cash Flow, Charts, ROE

Invests in FMCG products that he uses/consumes

Invests in large cap because it is more secure and not volatile

Chooses type of business he wants to invest in, after which he does DYOR (Favours tech stocks

Invests on dips

Invests in trending, top bought/ sold stocks

Wants & needs

Need product walkthrough videos

Advice should be with source

Wants advice as to what stocks would be good 1 year down the line based on macro and news

Wants mood of the market

Wants screener or Moneycontrol like info

Needs categorising like smallcase

Charges should be clear

Current experiences

User friendly and has a good referral program (Groww)

Quarterly report of stocks. It is useful in analysis (Upstox & Groww)

Simplicity (Groww)

Widely used (Kite)

Do not understand any of the data (Groww & Kite)

No inferences about the market (Kite)

Watchlist is restrictive, want more (Kite)

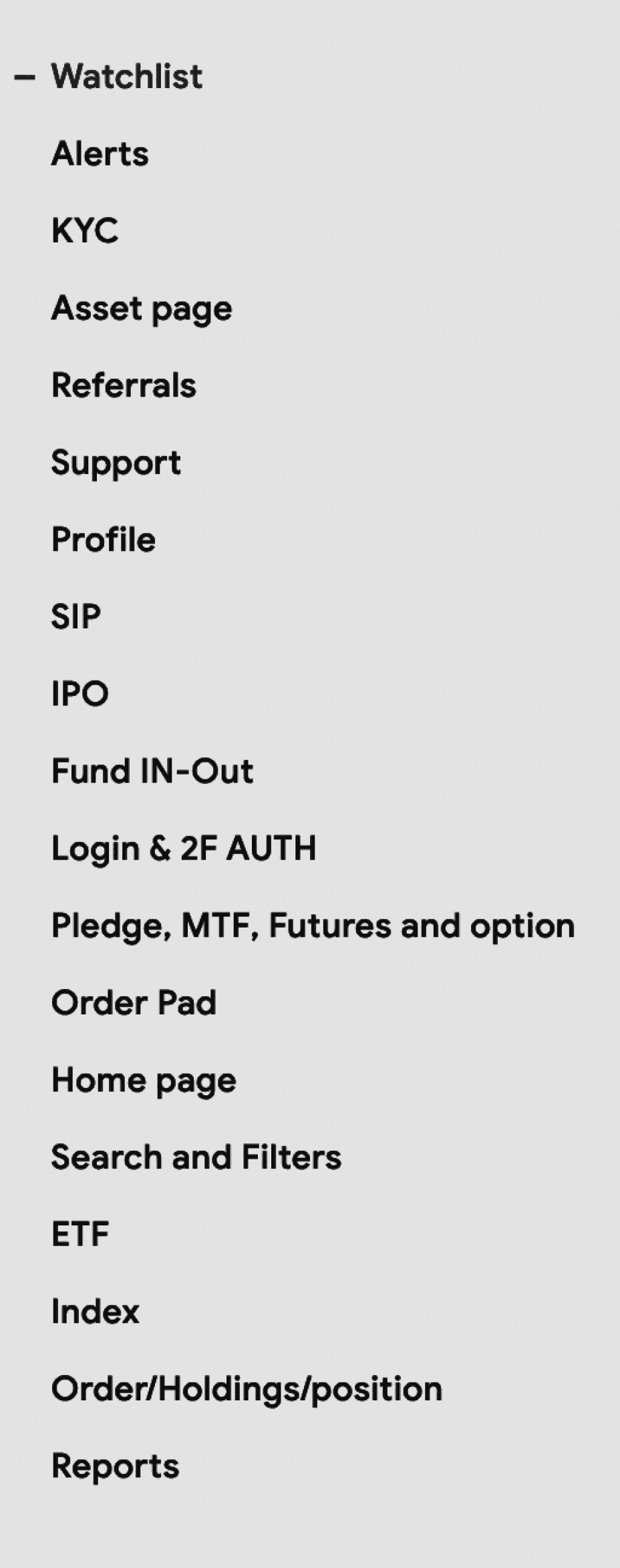

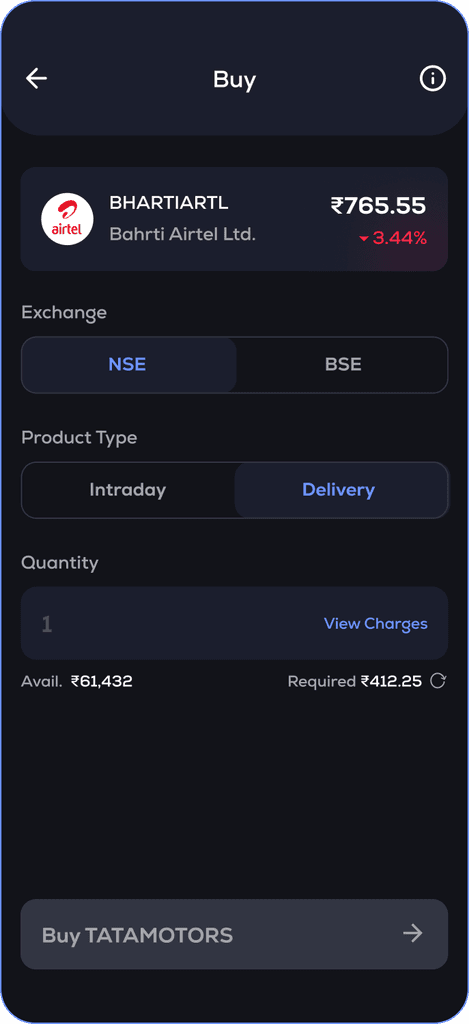

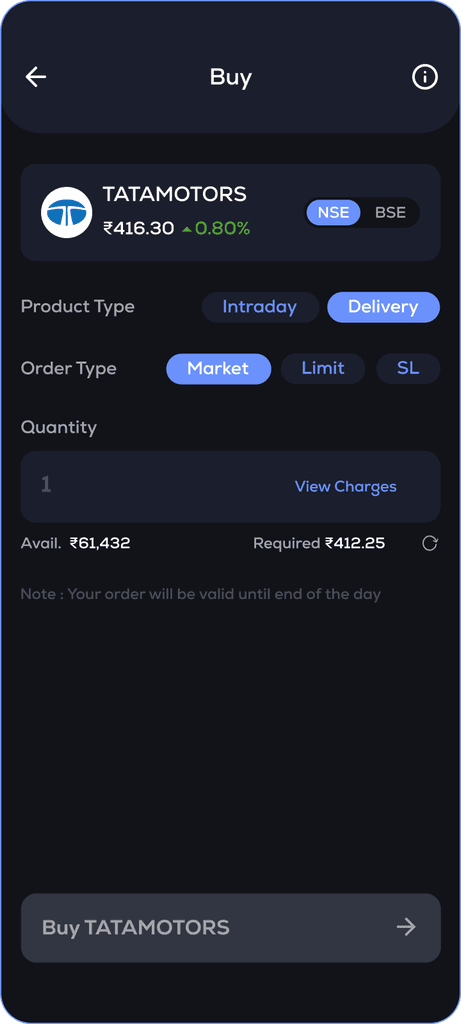

The three main screens and the problems

Home page: The decision making starts from here and the variety of stocks listed on the home is not enough, users are tired of seeing the redundant and infamous companies and even seeing unknown and random listed companies is not helping them with the execution of their new trade

Asset page: the information here seems to be monotonous, just numbers is not something that a new user will fairly want to see and perceive, there is no separation of summaries and advance information

Order pad: Confusion seemed to be everyones problem, people who are less aware usually play a safe game. Not everyone is sure of the product under which they are executing and order and what the the different order types, it just goes with the flow of any app they are using to execute thier trade

Design Goals

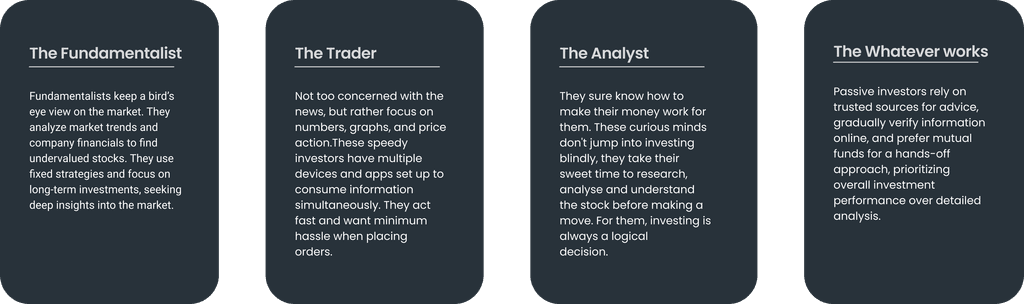

User stories with respect to personas

I constructed an extensive list of user narratives for each persona. This operation established the foundation for our MVP.

User

As a Trader

Action

I need to to place a trade in less time

Motivation

Seeing an opportunity in the market

Outcome

to meet the potential gain in near future

User

As a Fundamentalist

Action

I need to scan important data

Motivation

To ensure the stock is worth investing

Outcome

So that no other factor is responsible for my loss

User

As a Fundamentalist

Action

I need to acquire knowledge of any unfamiliar sector

Motivation

To make sure if there are any competitive stock in my research

Outcome

So that I am not in regret o0f not knowing about the industry already

User

Action

I need see stocks validated to sell

Motivation

as I am holding it for a while, and hearing its fall

Outcome

So that I dont have to face any loss on my gained profit

Design Goals

To target and to solve.

With all this information we were good to go ahead with our brainstorming sessions.

Usability | Learnability | Accessibility | Simple

Allowing users to discover stocks

How users relate stocks to the brands they use on a daily basis was still very unexplored, hence exploring

User scenario: Any new user is overwhelmed by landing on a stocks app, for them making a decision to invest is a big step but what next? They need something comforting, which engages them with the UI, I will call it a developing interest phase.

Future roadmap: Current flows includes some basic information incentivizing users in this flow is already in funnel along with some quality insights and analysis of the stocks that are being engaged on.

Asset page conversion : 63%

Sectoral stock discovery

Invest in ideas basiclally includes in itself around5-10 sectors like Semiconductors. persident's portfolio, oil & gas etc. allowing all the stocks displayed where they belong.

User scenario: For a fundamentalist it is important to acquire knowledge of sectors they are unfamiliar with, eazing discovery of stocks, Industry wise comparison, starring stocks in watchlist and so on.

Asset page conversion: 78.02%

Add to watchlist conversion : 47.45%

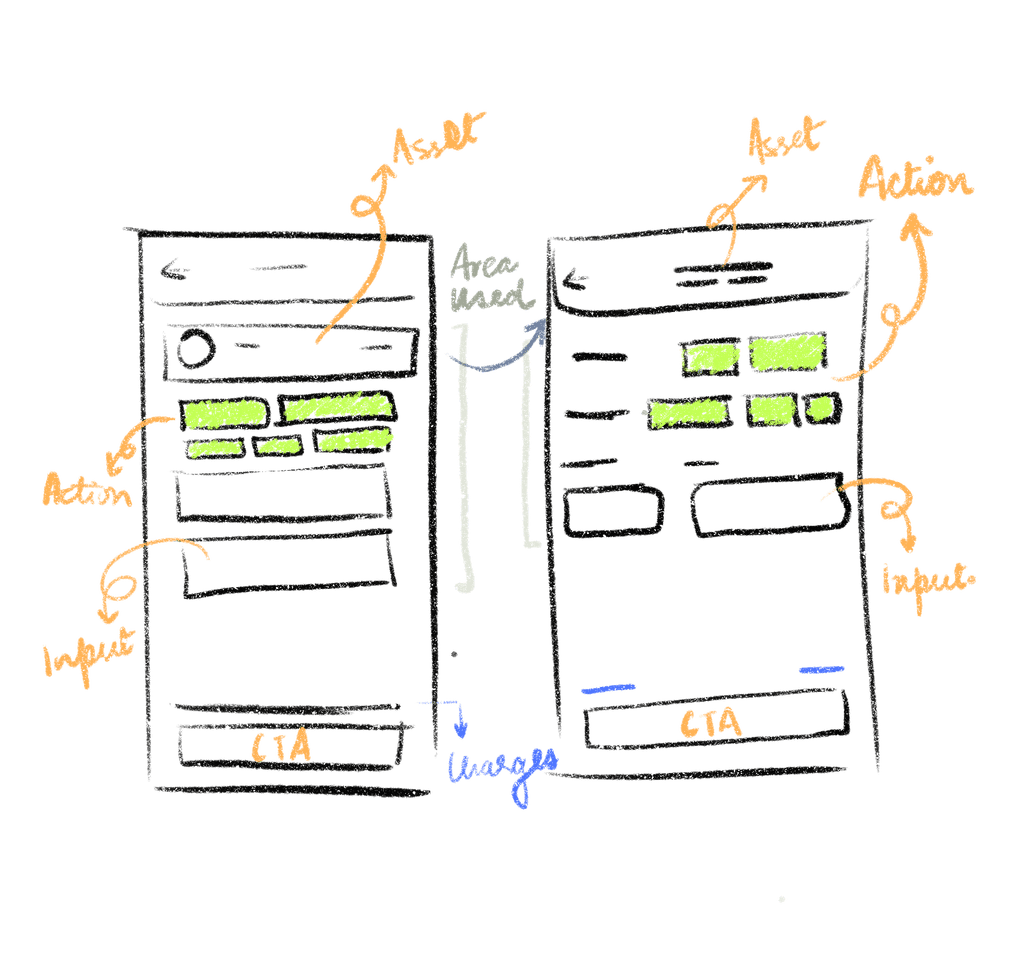

Order execution flow

Order execution flow comes up with complexities, we introduced the minimum order types in our MVP for retail and new users, where there learning curve is not sky rocketing, the future roadmap was to still introduce the advanced order types in a more concise way hence this was our foundation for an all in one order execution flow

User scenario: Around 80% of new and naive users are always overwhelmed with the execution flow, where they just usually go with the flow pressing the safe buttons and placing the order.

Iterations

April 2024 - March 2025

In the span of 11 months there were already 10L+ downloads in which, KYC signups and trade ready users have improved significantly (will talk about it in more detail in phase 3)! There was much more to iterate on our basic foundation, following the data and the features parked for later.

10L+

8L+

Signups

6L+

Trade ready

Designing the whole product from scratch was quite an experience, I have developed great understanding of so many things

An important area of development for me was prototyping. I discovered how fun is rapid iterations based on feedback in addition to creating something that looks clean. I learned something new from every iteration of the prototype, whether it is related to functionality or usability. I embraced the idea that failure in early stages is only a stepping stone to improvement.

My learning approach was significantly aided by collaboration as well. Collaborating with interdisciplinary groups has enhanced my appreciation for diverse viewpoints and abilities. It made me realize how important open communication is and how different perspectives may result in a stronger final product.

Finally, I became more aware of the need to strike a balance between creativity and pragmatism. Though it's simple to become buried in creative concepts, I discovered that maintaining